History Doesn’t Repeat, But it Often Rhymes: Time to Diversify Your Diversifiers

The world is currently facing a multitude of troubles. Inflation is running hot, recession is looming on the horizon, there is a war in Europe and tensions in Asia, and there are serious concerns of a banking crisis.

Key takeaways

- Improving diversification does not eliminate risk but it helps provide a better trade-off between expected returns and risks of a portfolio.

- Adding alternative asset classes to a portfolio has historically improved diversification of a traditional portfolio with stocks and bonds.

- Stock market corrections tend to be driven by fears of inflation, recession, or geopolitical risks, and bear markets result when such fears become reality.

With the world currently facing a multitude of troubles, uncertainty and anxiety are heightened, leaving investors to wonder what the future holds and how they can protect their portfolios.

Looking back through history, we can see that these types of challenges are not new. But we also see that investors have found ways to navigate challenges and come out ahead. Diversification has often been the key.

Back to basics

Spreading investments across different asset classes can reduce overall risk and increase the chances of achieving positive returns. To use diversification effectively, it’s important to understand its role.

Diversification is not hedging. Hedging is about eliminating risk, and that can be costly. Eliminating risk also results in an expected return that is—at most—the risk-free rate of return.[1] Diversification is intended to improve risk-adjusted returns—either by lowering the level of risk required to achieve a certain rate of return or by raising the expected return given a certain level of risk. Risk is not eliminated, but improving diversification should provide a better trade-off between the risk and return of a portfolio.

However, a blunt approach to diversification can easily fail, as it oversimplifies the concept of diversification by focusing on the mix of stocks and bonds. In 2022, both stocks and bonds, which usually do not move in sync, performed poorly:

- Stocks lost 18.1% and bonds lost 16.5%.[2]

- The volatility of stocks (annualized daily) was 24.1%, while the annualized daily volatility of bonds was 10.7%.

- This was a particularly bad year for bonds. In hindsight, bonds made the risk/return trade-off of a portfolio worse rather than better.

Fortunately, there are better ways to diversify. Adding alternative asset classes to a portfolio has historically improved diversification of a traditional portfolio with stocks and bonds. Case in point: In 2022, when stocks and bonds both fell, the *Bloomberg Commodity Total Return Index rose 16.1%. Daily volatility for the index was also high (23.1% annualized) because of the massive swings in commodity prices, but commodities were a powerful diversifier in 2022.

Learning from history

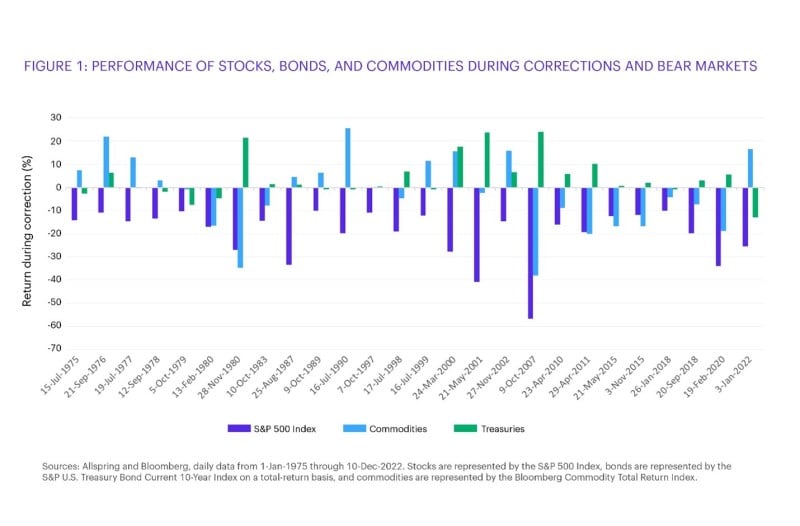

No single asset can perform well across every economic environment and geopolitical event. The most critical time for diversification is often when the main source of portfolio risk—stocks—is losing value. We can take a lesson from history by focusing on stock market corrections and bear markets. Figure 1 shows the performance of stocks, bonds, and commodities during every stock market correction (10% to 20% decline) and bear market (20% decline or worse) since 1975.

From 1975 to 1990, many stock market corrections coincided with bond market sell-offs. That changed during 2000 to 2020, when bonds rose as stocks sold off. Then in 2022, we reverted back to the bad-old-days when stocks and bonds both sold off.

Commodities are generally thought of as being highly correlated with stocks, meaning they typically move in the same direction. However, there are some notable exceptions. Inflation-driven sell-offs, like those of the 1970s and 2022, saw commodities rally while stocks tumbled.

Diversifying the diversifiers

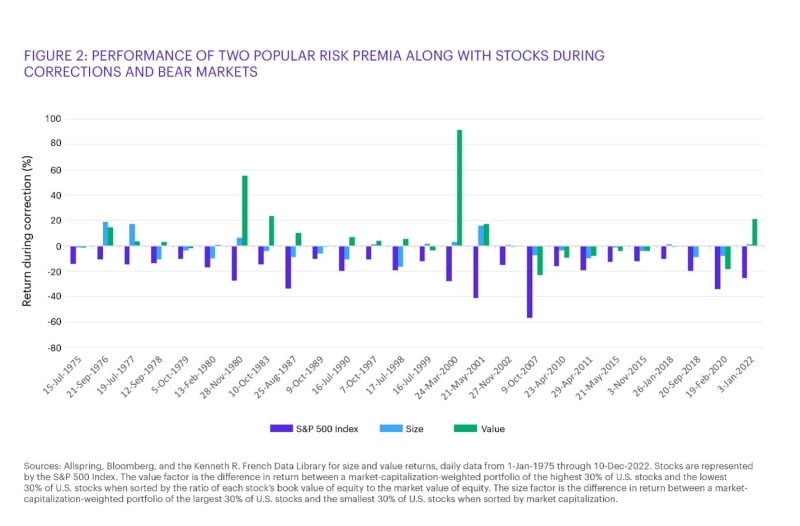

Investors are not limited to bonds and commodities to add diversification. Factors, or alternative risk premia, have been helpful diversifiers during many periods—especially during stock market sell-offs.[3] Figure 2 shows performance of two popular risk premia—size and value—along with stocks.

Before the dot-com bubble burst in 2001, the value premium (which favors stocks with low prices relative to their fundamentals) performed well during stock market drawdowns. In fact, the best returns of this timespan were during the bursting of the dot-com bubble. Since then, the value premium has tended to perform poorly during stock market drawdowns. We attribute the recent underperformance to the blunt way academics define this premium; in practice, asset managers can use a more nuanced approach to acquiring exposure to the value premium.

The size premium (which favors smaller stocks over larger stocks) has consistently done poorly during stock market sell-offs, with only six exceptions. Investors are typically attracted to the size premium’s potential for favorable returns during market recoveries and expansions.

The importance of diversifying across growth, inflation, and geopolitical risks

Stock market corrections tend to be driven by fears of inflation, recession, and geopolitical risks. Bear markets result when these fears become reality. To illustrate this point, consider how different asset classes have performed during some notable historical episodes:

- Recessions without high inflation: In recessions without high inflation—such as the 1950s, 1990, and 2001—stocks suffered the most while bonds provided ballast in a balanced portfolio. However, alternative investments, such as long-short strategies, were able to harvest return differences across investments without making a directional bet on the market.

- Stagflation of the 1970s: Inflation was high and economic growth was low. In this environment, stocks and bonds both struggled to produce positive returns. Conversely, commodities, such as gold and oil, performed well as investors sought protection against inflation.

- High growth/lower inflation of the mid-1980s: Stocks and bonds both performed well. However, real estate and commodities lagged as investors favored traditional financial assets. Stock market corrections during this era were driven by a fear of a return to 1970s-style stagflation, which is likely why bonds did not tend to rally much as stocks sold off.

- Low and stable growth and inflation of the early 2000s and post Global Financial Crisis: Investors became confident that central banks would not allow inflation to roar back. Added to this was the emergence of the “Fed put” when the Federal Reserve (Fed) intervened notably in 1987, 1998, and 2008 as stocks sold off aggressively. The negative correlation between stocks and bonds became entrenched in investor expectations.

- During rate-hiking cycles: As in the current environment, bonds have tended to underperform while stocks may continue to perform well as long as economic growth remains strong. The period of time when the Fed holds rates tends to be best for bonds. Stock can do well depending on how quickly the higher rates begin to take a toll on growth.

- During rate-cutting cycles: Bonds tend to do very well, whereas stocks have been mixed. The Fed tends to be late in recognizing that growth has slowed. However, during 2017 to 2019, the Fed appeared to be trying to be proactive in staving off a slowdown. Whether stocks can do well depends on whether the Fed is slow to recognize deteriorating conditions or it tries to exercise foresight.

- During periods of conflict: In times of conflict, such as the Korean War and the Iraq War, safe-haven assets such as gold and Treasuries have tended to perform well as investors sought protection against geopolitical risks. Other commodities—especially energy—have rallied aggressively during these periods.

Diversify for the future, not the past

History can be a useful guide in understanding how markets respond to different types of risks. But investors are wise to remember that while history doesn’t repeat, it often rhymes.

It’s also important to consider that investing for a worst-case scenario comes at a steep cost. Since 1857, the average recession lasted only 17 months while the average expansion was 41 months. Investing with a recession or crisis in mind forfeits the gains that happen outside recessions and crises. We aim to navigate the changing macroeconomic and market environment by developing an informed view of what is going on and what is likely to come. We assess the risks and decide whether these risks are well compensated. Taking an evidence-based approach to investing helps to be proactive for the next market move.

History also teaches us that there is no single approach to diversification. Diversifying your diversifiers helps manage uncertainty and prepare for hidden risks. Currently, the Fed is close to holding rates steady, growth looks to be strong but stalling, and inflation is high but subsiding. There is also geopolitical conflict. Looking at the playbook from historical episodes suggests to us that diversified diversification, including commodities and alternative risk premia in portfolios, makes the most sense.

Diversification does not ensure or guarantee better performance and cannot eliminate the risk of investment losses.

[1]. In the U.S., the risk-free return typically refers to the 90-day Treasury bill rate.

[2]. Stocks are represented by the *S&P 500 Index after dividends earned, and bonds are represented by the *S&P U.S. Treasury Bond Current 10-Year Index on a total-return basis.

[3]. Factors target specific drivers of return across asset classes, such as size, value, momentum, volatility, and quality.

*Bloomberg Commodity Total Return Index: The Bloomberg Commodity Total Return Index is an index that tracks the performance of futures contracts on commodities and adds the returns from investing in U.S. Treasury Bills. You cannot invest directly in an index.

*Standard & Poor’s 500 Index (S&P 500 Index): The S&P 500 Index consists of 500 stocks chosen for market size, liquidity, and industry group representation. It is a market-value-weighted index with each stock’s weight in the index proportionate to its market value. You cannot invest directly in an index.

*S&P U.S. Treasury Bond Current 10-Year Index: The S&P U.S. Treasury Bond Current 10-Year Index is a one-security index comprising the most recently issued 10-year U.S. Treasury note or bond. You cannot invest directly in an index.