The Secure Act 2.0: Closing the Retirement Savings Gap

As the dust settles following the passage of the SECURE Act 2.0 in late 2022, we thought it would be worth digging into one of its key provisions to highlight how plans and various plan participants might benefit from this legislation.

Key takeaways

- Section 110 of the Secure Act 2.0 allows for the treatment of student loan payments as elective deferrals for purposes of matching contributions.

- Indebted participants can benefit from closing the savings gap with debt-free counterparts, and employers can benefit by attracting and retaining employees.

- Defined contribution plan experts at Allspring can help sponsors consider how the provision and sections of the law can help participants elevate investing to be worth more.

One of the problems facing borrowers with heavy student loan debt is the added difficulty in accruing retirement savings. According to the Chamber of Commerce,[1] aggregate student debt in the U.S. now stands at an astounding $1.75 trillion dollars. Of this total, $500 billion is owed by borrowers between the ages of 25 and 34. On average, each borrower owes more than $37,000!

Digging into the data, we see different debt burdens among groups of borrowers. For example, minorities are more likely to have taken out federal student loans to fund their education: 77% of African Americans have used these programs, compared with the national average of 60% for all students. Women are also more likely to have taken out student loans and have accrued higher loan balances than their male counterparts. The net effect is that it takes longer for women to repay their student debt and accrue retirement savings.

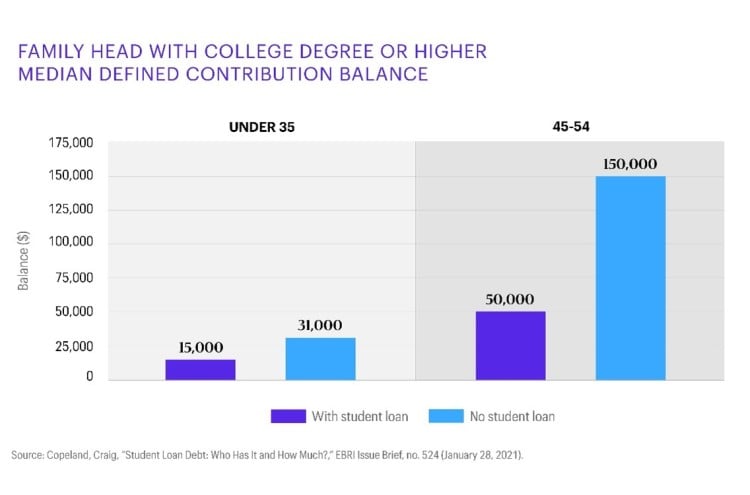

Research published by Craig Copeland of the Employee Benefit Research Institute (EBRI) in January 2021[2] shows the impact of student debt burdens on retirement savings across age groups. Specifically, they found that retirement plan participants under the age of 35 with student debt saved less than half that of their debt-free counterparts. The gap grew considerably for older cohorts—indebted plan participants aged 45 to 54 accrued only one-fifth the balances of those with no student debt. Clearly, ongoing debt burdens are channeling available resources to debt service and are forcing borrowers to forgo the benefits of compounding investment returns within their retirement plans.

How does the Secure Act 2.0 address these challenges?

Section 110 of the Act allows for the treatment of student loan payments as elective deferrals for purposes of matching contributions. This provision goes into effect in 2024. Importantly, it is an optional provision for 401(k), 403(b), and 457 plans, among others. Plans wishing to adopt it will need to amend their plans to provide matching contributions based on the repayment of student loans as Qualified Student Loan Payments (QSLPs). A plan must treat the QSLP match in the same manner as traditional elective participant deferrals. Importantly, the employer can rely on employee certification of student loan payment to ease record-keeping burdens.

We think there are valuable benefits of this legislation for both plans and participants. It will allow indebted participants to close the savings gap with debt-free counterparts as they service their loans. Employers may benefit by using this provision to attract new talent and retain employees in a tight labor market. As a result, we expect this option to be a popular addition to many plans in 2024 and beyond. In the meantime, we encourage plan sponsors and their advisors to dig into their employee base and understand how the Secure Act 2.0 can help employees meet their long-term retirement savings goals and improve overall financial security.

As always, the defined contribution plan experts at Allspring Global Investments stand ready to help plan sponsors consider how this provision and other sections of the law can help their participants elevate investing to be worth more.

[1] Source: US Student Loan Debt Statistics – What is the Average Student Loan Debt? | Chamber of Commerce

[2] Source: Craig Copeland, “Student Loan Debt: Who Has it and How Much?” EBRI Issue Brief 524 (January 28, 2021).